Turn your M&A thesisinto perfect targets.

Find that diamond in the rough with custom-built, AI-powered assessments of target companies.

Revolutionize Your M&A Workflow

Discover targets faster, make data-driven decisions, and gain a competitive edge with our AI-powered solution.

-

Built for M&A Professionals - Purpose-built to tackle the unique challenges faced by corporate M&A teams, private equity firms, and investment banking professionals.

-

AI-Powered Precision - Leverage cutting-edge AI to rapidly identify and evaluate targets with real-time, scalable insights.

-

Streamlined Process - Save time and reduce costs by minimizing reliance on manual research and crufty legacy tools.

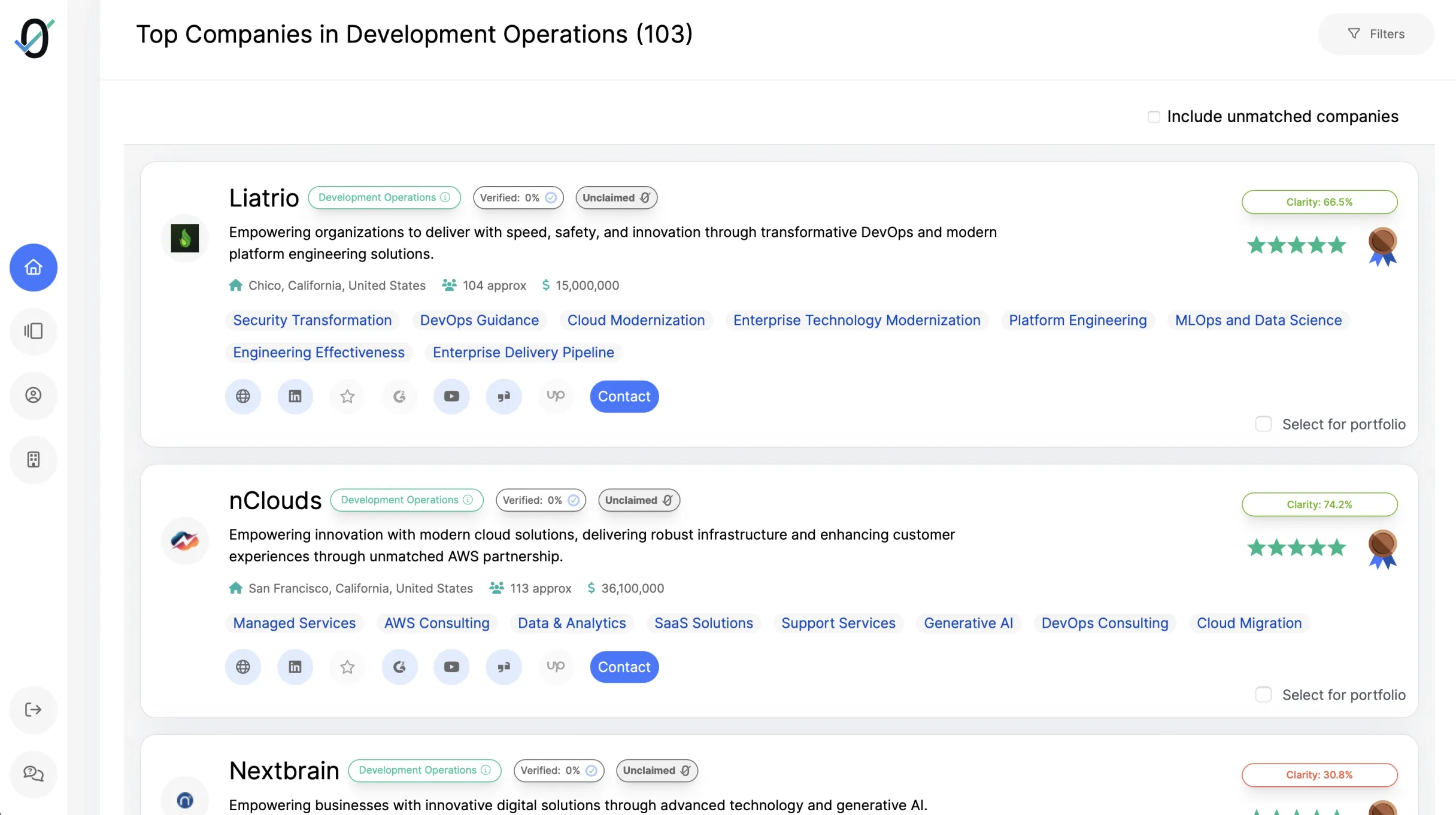

Unlock Smarter M&A Decisions

Streamline your acquisition strategy with AI-powered insights, precision scoring, and direct deal connections.

For Corporate M&A Professionals

-

Thesis-Driven Search - Align targets with your strategic objectives using customizable AI-driven insights.

-

Rapid Prioritization - Save time and resources by focusing only on the highest-potential targets.

-

Direct Connections - Access leadership data and curated recommendations and take the guesswork out of deal sourcing.

For Private Equity Firms

-

Streamlined Deal Sourcing - Quickly identify platform or add-on targets that match your thematic investment thesis.

-

Enhanced Target Vetting - Reduce risk with comprehensive, verified data and insights.

-

Access to Niche Markets - Unlock opportunities for proprietary deal flow beyond what traditional methods provide.

For Investment Banks & Advisors

-

Improved Deal Clarity - Use AI to generate clearer, more actionable insights from fragmented datasets.

-

Detailed Scoring - Identify the best targets with proprietary clarity scores and risk metrics.

-

Data-Driven Decision Making - Make faster, better-informed recommendations for your clients

Ready to Transform Your M&A Process?

Spend 30 minutes with us to see how sc0red can accelerate your deal sourcing.