Navigating the M&A Technology Landscape

By Zack Walmer & James Menapace on 4/30/2025

- technology

- M&A workflow

- Artificial Intelligence

The buy-side M&A landscape is undergoing a profound transformation driven by technological innovation. What was once a process heavily dependent on relationship networks, manual research, and intuition is rapidly evolving into a more systematic, data-driven approach. Today’s most successful acquirers are using advanced technologies to identify targets more effectively, conduct thorough due diligence more efficiently, and execute more value-accretive transactions.

The integration of artificial intelligence, automation, massive datasets, and sophisticated data analytics is reshaping every phase of the deal lifecycle. These technologies aren’t merely streamlining existing processes; they’re enabling entirely new approaches that offer strategic advantages to early adopters. For corporate development teams, advisors, and financial sponsors alike, embracing these innovations is becoming less of a competitive edge and more of a competitive necessity.

In this article, we explore how technology is disrupting traditional methodologies across the M&A deal lifecycle, some of the tools & capabilities enabling this transformation, and the trends that will define the future of dealmaking.

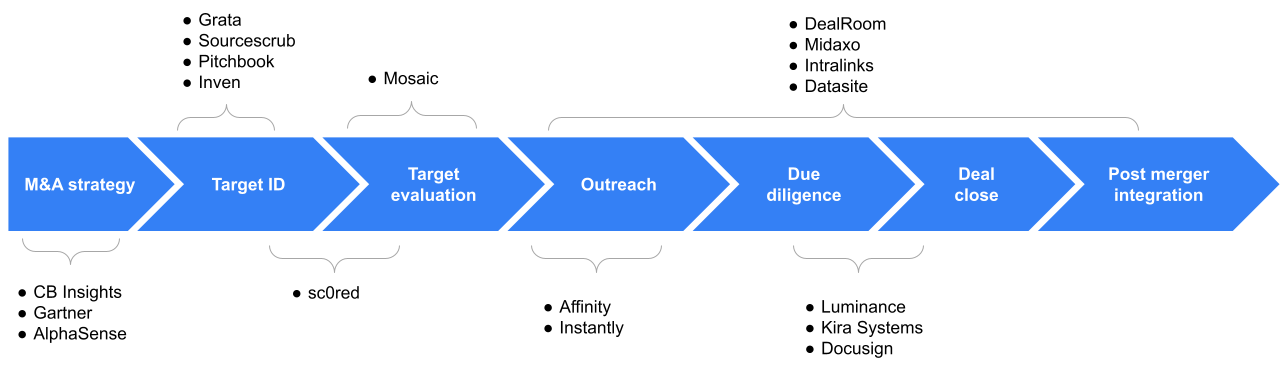

Image 1: Illustrative tool summary across the M&A value chain

1. M&A Strategy & Market Analysis

M&A strategy is a component of a company’s overall corporate strategy for corporates and the investment thesis for sponsors. It involves research-heavy processes that require teams to manually compile a factbase, including market reports, competitor analysis, and industry trends. Many businesses still rely exclusively on legacy methods, such as spreadsheets, PowerPoint, interviews, surveys, and desktop research. The executive leadership team may convene an offsite to review the factbase and strategic options. This approach is time-consuming, often results in information gaps, biases, and can quickly become outdated in rapidly evolving markets.

AI-powered market intelligence platforms are changing how acquirers approach strategy formation. Tools like CB Insights use machine learning to analyze millions of data points across startups, patents, investments, and news to identify emerging technologies and market opportunities. Tools such as AlphaSense and PitchBook combine comprehensive private market data with advanced analytics to help identify industry trends and potential acquisition targets that align with an acquisition thesis.

The most significant advancement in this space is the application of predictive analytics to anticipate market shifts and refine investment theses. According to Deloitte’s M&A Trends Report, a majority of M&A executives believe that AI and predictive analytics improve their ability to identify, screen, and prioritize targets1. These tools can now forecast industry consolidation patterns, identify emerging disruptors before they gain mainstream attention, and quantify the potential impact of various macro trends on specific sectors. Corporate development teams are increasingly using these insights to develop more forward-looking M&A strategies rather than reacting to obvious market movements.

2. Target Identification

Target identification has traditionally relied on the personal networks of executives, recommendations from investment bankers, conference attendance, and manual research. This approach limits the universe of potential targets to those already within an organization’s sphere of awareness, potentially missing ideal candidates operating outside these networks.

AI-driven acquisition search tools have dramatically expanded the scope and efficiency of target identification. Platforms like PitchBook initially emerged to provide comprehensive databases of private companies, primarily focusing on middle- and upper-middle-market companies that received outside capital (e.g., VCs, growth equity, and financial sponsors). Grata and SourceScrub entered the market to improve search functionality for harder-to-reach private companies that may not have received outside capital.

Generative AI is accelerating industry-specific target discovery by analyzing vast amounts of unstructured data to identify companies with a relevant strategic fit and actionable opportunities. According to a Bain & Company study, 60% of interviewed private equity (PE) firms are using at least one AI tool for sourcing, screening, or due diligence.² These tools not only improve the effectiveness and efficiency of outreach but also provide a critical feedback loop on the viability of M&A strategies. If a strategy yields few actionable targets, teams can quickly pivot rather than pursue unrealistic acquisition paths. This represents a fundamental shift from periodic target reviews to continuous, AI-powered discovery processes.

3. Initial Evaluation & Triage

Initial evaluation of acquisition targets typically involved analyst-driven assessments and the manual creation and review of investment materials. This process was time-intensive and often inconsistent, with different team members applying varying standards to different opportunities – a pain point that is magnified for financial sponsors managing add-on M&A of their portfolio companies or larger enterprises with a central corporate development team and “local” business development resources sourcing opportunities.

AI scoring and due diligence automation tools are standardizing and accelerating the initial evaluation process. Platforms like Datasite (formerly Merrill Corporation), Intralinks, and sc0red now offer target analysis capabilities that can rapidly assess company financials, market position, and strategic fit. These tools can automatically flag potential issues for deeper investigation and provide standardized scoring across multiple dimensions.

sc0red in particular, is changing the game by applying algorithmic approaches to score and rank potential targets based on a deal team’s specific criteria using AI. This unique approach replicates the work of M&A analysts to create bespoke breakdowns of whether a target is a good match for a buyers (or sellers) unique needs. This novel application takes the “raw material” from large databases and public sources and creates focused research on targets to replicate the work of human analysts at scale. With user-specific analysis, it can also create deal rationale for company leadership based on dozens or hundreds of public and private data sources.

Overall, natural language processing (NLP) is driving more sophisticated company profiling for faster go/no-go decisions. NLP tools can now analyze earnings calls, press releases, customer reviews, and other unstructured data sources to build comprehensive profiles of target companies in a fraction of the time required for manual research. This enables corporate development teams to make more informed initial decisions and focus their attention on the most promising opportunities. The integration of these tools with existing CRM systems is creating seamless workflows that track targets from initial identification through qualification and beyond.

4. Outreach & Engagement

Initial outreach to potential acquisition targets often involves sending generic cold emails, attending industry conferences, or banker-led introductions to known companies. These methods usually result in low response rates and inefficient use of the corporate development and business development teams’ time.

AI-assisted personalized outreach platforms have transformed how acquirers initiate conversations with targets. Tools like Affinity track relationship networks across organizations to identify the strongest potential connections to target companies. Tools like Instantly help craft and manage personalized outreach messages based on an understanding of the target’s business, resulting in higher response rates.

Relationship intelligence software optimizes deal initiation by mapping complex networks of connections and identifying the optimal paths to engage with potential targets. The most advanced platforms can now suggest the most effective approaches based on historical interaction data, timing considerations, and even sentiment analysis of previous communications. Ultimately, developing deep, personal, authentic relationships with potential partners remains a critical step in a successful M&A process. These technologies don’t replace critical executive-to-executive relationship building; instead, they greatly enhance the efficiency of finding the right opportunities and establishing meaningful connections.

5. Due Diligence & Deal Execution

Due diligence has historically been labor-intensive, requiring large teams of consultants, accountants, analysts, and lawyers to analyze thousands of documents manually. While digital technology and video conferencing technology have long ago moved us away from traveling to “war rooms” to review physical files, the diligence process largely remains manually intensive. It is an expensive process typically performed under short deadlines that can often result in key risks being overlooked due to human error or time constraints.

Virtual data rooms and diligence tools have evolved from simple document repositories and workflow tools to sophisticated platforms with AI-driven contract review capabilities. Tools like Luminance and Kira Systems use machine learning to automatically identify and extract key provisions from contracts, significantly reducing review time while improving accuracy. These platforms can analyze thousands of documents in hours rather than the weeks required for manual review.

The integration of machine learning enables automated synthesis and real-time risk assessment throughout the due diligence process. Research from EY suggests that “A close collaboration between AI software and experienced humans will be vital to offer top-notch M&A due diligence services in the future”3. These technologies can identify patterns across disparate documents, flag inconsistencies, and highlight potential risks that might be missed in traditional reviews. Forward-thinking acquirers are using these insights to develop more sophisticated risk mitigation strategies and negotiate more favorable terms based on quantifiable risk assessments. The most advanced systems can now predict potential integration challenges based on historical deal data, helping teams proactively address issues before they impact deal value.

6. Deal Closing

The closing process typically involved legal teams manually coordinating multiple workflows (i.e., the closing checklist), tracking numerous signatures, and ensuring compliance with various regulatory requirements. This approach was prone to delays and often created last-minute complications.

Technology is streamlining the closing process through blockchain-enabled smart contracts and sophisticated e-signing tools like DocuSign. These platforms automate many of the mechanical aspects of closing, reducing the risk of errors and accelerating the process. Secure digital signature capabilities have eliminated many of the logistical challenges associated with obtaining signatures from multiple parties across different locations.

The automation of legal and compliance workflows is extending beyond simple document execution. According to an article in The Journal of Robotics, Artificial Intelligence & Law, “These advanced systems can sift through vast volumes of documents in a fraction of the time it would take a human, automatically extracting and identifying key clauses, obligations, risks, and anomalies”4. Advanced platforms now manage complex closing checklists, automatically generate closing documents based on negotiated terms, and track regulatory approvals across multiple jurisdictions. These technologies ensure that closing conditions are satisfied in the correct sequence and provide real-time visibility into the status of all closing-related activities. As regulatory requirements continue to increase in complexity, these automated compliance tools are becoming increasingly valuable in efficiently managing closing risk.

7. Post-Merger Integration (PMI) and Value Creation

Post-merger integration has traditionally been managed by siloed teams working through complex systems and organizational integrations, oftentimes with limited M&A integration experience and with limited visibility across workstreams. This approach often resulted in integration delays, unrealized synergies, and value leakage.

AI-powered PMI management platforms like DealRoom and Midaxo are providing comprehensive solutions for planning and executing integrations. These tools offer structured frameworks for integration activities, real-time progress tracking, and centralized communication capabilities. They enable integration teams to identify interdependencies between workstreams and proactively address potential bottlenecks.

Predictive analytics is transforming how acquirers approach cultural and operational synergy. The Institute for Mergers, Acquisitions & Alliances (imaa) reports that AI-powered automation can significantly reduce the time and effort required for integration tasks5. Advanced algorithms can now analyze organizational data to identify potential cultural conflicts, predict employee retention issues, and recommend specific integration approaches based on the characteristics of the combined organizations. These insights allow integration teams to focus on the most critical areas for preserving value and accelerating synergy realization. The most sophisticated platforms can even suggest optimal integration timelines based on historical data from similar transactions.

Conclusion

Technology is fundamentally changing how buy-side M&A is conducted across every phase of the deal lifecycle. From AI-powered target identification to automated due diligence and predictive integration planning, these innovations are enabling more acquirers to execute successful transactions with greater efficiency and effectiveness.

The rise of AI-driven solutions is the most transformative trend across all phases of M & A. Machine learning algorithms are processing vast amounts of structured and unstructured data to surface insights that would be impossible to identify manually. Natural language processing is automating document review and enabling more sophisticated analyses of company communications. Predictive models are helping dealmakers anticipate challenges and opportunities before they emerge.

Looking ahead, the next frontier in M&A technology will likely center around systems that combine AI tooling with senior domain expertise to deliver world-class outcomes across the entire deal lifecycle. According to Bain & Company research, nearly 80% of companies using generative AI in their M&A processes said that they benefit from reduced manual efforts2. These comprehensive solutions will combine the automation of routine tasks with predictive insights that inform strategic decision-making. As these technologies continue to evolve, the gap between technology-enabled acquirers and traditional players will likely widen, making technological sophistication an increasingly important determinant of M&A success.

For corporate development teams and financial sponsors, the message is clear: embracing these technological innovations is no longer optional but essential for maintaining competitive relevance in an increasingly sophisticated M&A landscape. The ability to knit these tools together in a seamless workflow that drives real value will still require experienced human professionals wielding them with great skill.

—---------------

About the Authors

Zack Walmer

Bio:

Zack Walmer: Zack is the co-founder of sc0red, and brings over 15 years of experience in driving organic and inorganic growth for organizations across diverse industries. Prior to co-founding sc0red, he served as the co-founder of Geigsen Group, where he successfully helped companies execute strategies by connecting operations with culture and people. With a practical approach and expertise in strategic planning, Zack is focused on scaling sc0red to build impactful partnerships and transform businesses.

Bio:

James Menapace: James is the principal and founder of JEM | C3 an AI-enabled buyside M&A consultancy. JEM | C3 works with companies to improve their end-to-end M&A process or provide flexible capacity anywhere along the M&A lifecycle. Prior to JEM | C3, James led the corporate development teams of both publicly traded and sponsor-backed, private companies, including Cognizant, Pearson and Vista Equity and Clearlake portfolio companies. He began his M&A career in investment banking at Goldman Sachs. Throughout his 20+ year career, he has built a reputation as a collaborative strategy & finance executive that has completed over 40 M&A transactions in B2B SaaS and Technology Services.

References

[^1]: Deloitte. (2025). “2025 M&A Trends Survey.” https://www2.deloitte.com/us/en/pages/mergers-and-acquisitions/articles/m-a-trends-report.html

[^2]: Bain & Company. (2025). “Generative AI in M&A: You’re Not Behind - Yet.” https://www.bain.com/insights/generative-ai-m-and-a-report-2025/

[^3]: EY. (2024). “How AI will impact due diligence in M&A transactions.” [https://www.ey.com/en\_ch/insights/strategy-transactions/how-ai-will-impact-due-diligence-in-m-and-a-transactions)

[^4]: The Journal of Robotics, Artificial Intelligence & Law. (2025). “The Impact of Artificial Intelligence on M&A Deals - Part I.” [https://www.reedsmith.com/en/perspectives/2025/03/impact-of-artificial-intelligence-ma-deals-part-i)

[^5]: Institute for Mergers, Acquisitions & Alliances. (2023). “Transforming the M&A Process: The Current and Future Role of Artificial Intelligence.” [https://imaa-institute.org/blog/the-future-role-of-artificial-intelligence-in-mergers-and-acquisitions/?utm\_source=chatgpt.com\#h-streamlining-post-merger-integration-and-separation-with-ai)

Upgrade your M&A tech stack today

Insert sc0red into your workflow to get immediate, clear, unbiased ratings for M&A acquisition targets.